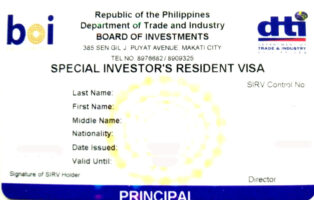

The Philippines Special Investor’s Resident Visa (SIRV) is an attractive option for Australian investors seeking long-term residency in the country. This visa grants holders the right to reside in the Philippines indefinitely, provided they maintain their investments. Understanding the Philippines’ investor visa requirements and the application process is essential for those looking to leverage business opportunities there. This guide provides a step-by-step overview of how to apply for SIRV from Australia, covering eligibility, documentation, and the benefits it offers to Australian citizens.

Australia and the Philippines maintain strong business ties, making the SIRV a strategic visa for investors aiming to capitalize on the growing Philippine economy. Whether you are an entrepreneur, a business executive, or an investor looking for regional expansion, the SIRV can provide a streamlined path to residency and business opportunities in the country. Below, we list everything Australian applicants need to know about securing this visa.

Understanding the Philippines SIRV Eligibility Criteria

Before applying for the SIRV, it is crucial to determine whether you meet the necessary qualifications. The Philippines SIRV eligibility criteria include:

- Minimum Investment Requirement: Applicants must invest at least US$75,000 in qualified Philippine investments, which must be maintained for as long as the SIRV is active.

- Eligible Investment Areas: The investment must be in publicly listed Philippine corporations, government bonds, or other Securities and Exchange Commission (SEC)-approved ventures.

- Nationality: The applicant must be a foreign national from an eligible country, including Australia.

- Good Moral Character: A clean criminal record is required. Applicants must secure a police clearance certificate from Australia and any other country where they have resided in the past five years.

- Medical Fitness: Applicants must pass a medical examination proving they are free from contagious diseases and fit to reside in the Philippines.

- Financial Stability: Proof of funds must be presented to fulfill the investment commitment. This includes bank statements or investment account records.

These criteria ensure that only legitimate investors who contribute to the Philippine economy are granted residency. Meeting these requirements is crucial for securing SIRV approval.

Preparing the Required Documents for an SIRV Application

Once eligibility is confirmed, gathering the necessary documents is the next step. The Philippines investor visa requirements include:

- Completed SIRV Application Form: The applicant must accurately fill out and sign this document.

- Valid Passport: The passport must be valid for at least six months beyond the intended stay in the Philippines.

- Proof of Investment Funds: Bank statements, investment records, or a certificate of deposit proving the applicant has the required funds.

- Police Clearance Certificate: A document from the Australian Federal Police or relevant authority proving that the applicant has no criminal record.

- Medical Certificate: Issued by a licensed physician, confirming the applicant is in good health and free from contagious diseases.

- Affidavit of Undertaking: A legal document where the applicant pledges to complete the investment within the required period.

- Proof of Business Engagements: If the applicant has already started a business in the Philippines, supporting documents such as SEC registration, business permits, and tax records should be included.

Proper documentation is critical in ensuring a smooth and successful application process. Any errors or omissions in these documents could lead to processing delays or rejection.

How to Apply for SIRV from Australia

Australian investors can apply for the SIRV from Australia or upon arrival in the Philippines. The application process involves multiple steps to ensure compliance with Philippine laws and regulations.

- Step 1: Initial Application

-

- Submit the application to the Philippines’ Board of Investments (BOI).

- Provide initial supporting documents, including proof of investment funds and police clearances.

- Pay the corresponding processing fees.

-

- Step 2: Visa Issuance

- The applicant will be issued an SIRV under the Indefinite Stay Status upon provisional approval.

- The visa remains valid if the investment remains in the Philippines and meets BOI criteria.

- Step 3: Investment Confirmation

- The applicant must remit the investment amount to a BOI-accredited bank in the Philippines within 180 days of receiving the SIRV.

- Submit proof of investment to the BOI for full visa approval.

- Step 4: Visa Conversion and ACR I-Card Issuance

- Once the investment is validated, the visa is converted to a permanent SIRV.

- The applicant will be issued an Alien Certificate of Registration Identity Card (ACR I-Card) confirming their legal residence in the Philippines.

Following these steps ensures compliance with Philippine visa regulations for Australian investors and helps avoid delays.

Benefits of SIRV for Australian Citizens

Obtaining a SIRV offers multiple advantages for Australian investors, including:

- Permanent Residency: No need for constant visa renewals.

- Multiple-Entry Privileges: Allows unlimited entry and exit from the Philippines.

- Business and Investment Opportunities: Encourages foreign investments in key industries, including real estate, manufacturing, and technology.

- Family Inclusion: Spouses and dependent children can be included in the application.

- Pathway to Citizenship: Long-term SIRV holders may qualify for Philippine naturalization.

- Low Cost of Living: The Philippines offers a significantly lower cost of living than Australia, making it an attractive destination for investors and retirees.

These benefits make the SIRV a highly desirable option for Australian entrepreneurs and investors looking to expand their Asian presence.

Common Challenges and How to Overcome Them

While the SIRV process is straightforward, some applicants face difficulties, such as:

- Delays in Document Processing: Ensuring all paperwork is complete and adequately notarized can help avoid this issue.

- Investment Verification Issues: Choosing SEC-approved investments and keeping clear financial records prevent complications.

- Legal and Compliance Matters: Seeking professional assistance from visa consultants can smoothen the process.

By anticipating potential challenges, Australian investors can navigate the application process with minimal hassle.

Why Choose WorkVisaPhilippines for Your SIRV Application?

Securing a SIRV requires precision and compliance with government regulations. WorkVisaPhilippines.com is a trusted provider specializing in work and investor visas. Our experienced consultants assist clients in preparing the necessary documents, meeting investment conditions, and ensuring a smooth approval process.

We provide end-to-end support, including:

- Personalized consultation on investment options.

- Assistance with document preparation and submission.

- Liaison with Philippine immigration and investment authorities.

- Ongoing support for visa renewals and compliance.

Choosing WorkVisaPhilippines.com ensures a seamless experience for Australian investors seeking a Philippines Special Investor’s Resident Visa.

Key Takeaways

The Philippines Special Investor’s Resident Visa is an excellent option for Australian investors seeking long-term residency. By understanding the Philippines investor visa requirements and following the correct procedures, applicants can successfully secure their SIRV. With professional assistance from WorkVisaPhilippines.com, the process becomes even more efficient and stress-free.

Is Assistance Available?

Yes! WorkVisaPhilippines specializes in helping Australian investors obtain their SIRV easily. Contact us today to schedule an initial consultation with one of our experts.

- Contact Us Here

- Fill Out the Form Below

- Call us at +63 (02) 8540-9623