Holders of the 9g Pre-Arranged Employment Visa in the Philippines are classified as resident aliens for tax purposes after staying more than 180 days in a calendar year, subjecting them to graduated income tax rates of 0-35% on Philippine-sourced income under the National Internal Revenue Code as amended by the TRAIN and CREATE Acts, with mandatory Taxpayer Identification Number (TIN) registration at the Revenue District Office (RDO) corresponding to their employer’s location, employer obligations for monthly creditable withholding tax remittances (BIR Form 1601-C), issuance of year-end BIR Form 2316 certificates, and participation in social security schemes like SSS, PhilHealth, and Pag-IBIG.

9g visa tax requirements remain independent of the visa category itself but are inextricably linked to employment income realization, with potential 15% preferential final tax rates available for qualifying regional headquarters (RHQ), regional operating headquarters (ROHQ), or special economic zone assignees, alongside double taxation treaty relief for certain nationalities.

Determining Your Tax Residency Status as a 9G Holder

The tax residency classification for 9g work visa holders hinges not on the visa type but on physical presence and income sourcing under Section 22(F) of the NIRC: Those staying more than 180 days in any calendar year qualify as resident aliens, liable for graduated personal income tax (PIT) on all Philippine-sourced income and potentially worldwide income if deemed permanent residents. This status activates upon employment commencement, rendering most 9g holders “resident aliens engaged in trade or business” subject to standard withholding and filing protocols.

Detailed classifications relevant to 9g visa tax requirements include:

- Resident Alien Engaged in Trade/Business: Standard for salaried 9g employees; PIT at 0-35% graduated rates on gross compensation after deductions/exemptions (e.g., PHP 250,000 basic personal exemption).

- Resident Alien Not Engaged: Rare for 9g; taxed only on Philippine-sourced income at graduated rates.

- Non-Resident Alien Engaged (<183 days): Graduated PIT on Philippine income; possible for short-term 9g.

- Non-Resident Alien Not Engaged: 25% flat final tax on gross Philippine income; inapplicable to typical 9g.

Tax treaties (with over 40 countries) may override via Most-Favored-Nation clauses, allowing lower rates or exemptions—claim via a BIR International Tax Affairs Division (ITAD) ruling. Consult annually as the stay duration shifts status.

Securing Your BIR Taxpayer Identification Number (TIN)

Obtaining a BIR TIN is non-negotiable for 9g holders prior to or concurrent with AEP/visa activation, serving as a prerequisite for payroll processing, social registrations, and BIR compliance—handled at the RDO servicing your employer’s principal place of business per Revenue Memorandum Order No. 25-2020 and Executive Order 98 for interim use.

Step-by-step TIN registration under 9g visa tax requirements:

- Employer Initiation: HR prepares BIR Form 1902 (for employees) with passport, 9g visa/AEP copies, and employer registration cert (BIR Form 2303).

- RDO Submission: File at Revenue District Office (e.g., RDO 039 Makati for CBD employers); no personal appearance needed post-EO 98.

- Issuance: BIR issues the TIN and Certificate of Registration (Form 1901) within 3-5 days; the employer provides a copy.

- Updates/Cancellations: Amend for address changes; cancel upon permanent departure via BIR Form 1905.

Failure blocks salary payments; retain for SSS/PhilHealth.

Employer Responsibilities for Withholding and Remittances

Philippine employers bear primary 9g visa tax requirements for creditable withholding tax on compensation, deducting monthly based on graduated tables (Revenue Regulations 2-98 as amended), remitting via BIR Form 1601-C by the 10th of the following month (December by January 25), and furnishing year-end BIR Form 2316 reconciliation certificates by February 28.

Withholding mechanics:

- Graduated Rates (2026): 0% (PHP 0-250k annual), 15% (250k-400k), up to 35% (>8M).

- Exemptions/Deductions: 13th month (PHP 90k exempt), de minimis (PHP 90k), non-taxable allowances.

- Annualization: For irregular pay (bonuses), compute as if even over 12 months.

- 15% Final Tax Option: RHQ/ROHQ/special zones; employer applies BIR ruling.

Audit-proof remittances prevent employer BIR penalties (25-50% surcharge + interest).

Personal Income Tax Returns and Filing Obligations

Most 9g holders benefit from substituted filing—employer 2316 cert substitutes personal ITR if no other taxable income—exempting quarterly/annual returns. Self-employed/side income mandates Form 1701Q (quarterly) or 1701A (annual).

Key filing details:

- Substituted: Automatic if solely salaried; 2316 suffices for audits/refunds.

- Required ITR: Multiple income sources, >PHP 250k non-compensation; April 15 deadline (extendable to October 15).

- Quarterly: May 15/Aug 15/Nov 15 for 1701Q.

E-file via EFPS; penalties PHP 1k-5k + 25% surcharge.

Value-Added Tax (VAT) and Other Indirect Taxes

9g visa tax requirements include VAT registration (12%) if gross sales exceed PHP 3M annually for professional services; pure salary earners are exempt, as the employer absorbs—the percentage tax (3%) alternative for non-VAT services.

- Threshold: PHP 3M sales/services.

- Filing: Monthly 2550M/quarterly 2550Q.

- Input VAT: Credits on business expenses.

Employers handle corporate VAT.

Mandatory Social Security and Welfare Contributions

9g employees register for tripartite social protections; the employer deducts/remits shares monthly, and treaty exemptions are limited.

| Fund | Employee % | Employer % | Monthly Cap (PHP) | Benefits |

| SSS | 4.7% | 9.5% | 20,000 | Pension, sickness, maternity |

| PhilHealth | 2.5% | 2.5% | None | Health insurance |

| Pag-IBIG | 2% | 2% | 5,000 | Housing/savings |

Register post-TIN (SSS R-1A form).

Treaty Relief and Special Tax Regimes

Over 40 DTAs reduce 9g visa tax requirements; apply BIR ITAD for cert (30% to treaty rate).

- US: 30% to 10-25%.

- EU: Often 15%.

- RHQ: 15% final (CREATE).

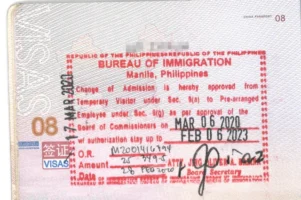

Employer Compliance, BIR Form 2316 Issuance, and Exit Tax Clearance

Employers hold primary responsibility under 9g visa tax requirements for accurate creditable withholding tax remittances through monthly BIR Form 1601-C filings (due by the 10th of the following month, with December payments by January 25), issuance of annual BIR Form 2316 Certificates of Compensation Payment/Tax Withheld by February 28 enabling employee substituted filing, and coordination of final pay withholding upon employment termination—while 9g holders departing the Philippines must secure BIR Certificate Authorizing Registration (CAR) for any registered assets/liabilities and ensure employer processes terminal pay per Revenue Regulations 2-98 as amended to facilitate smooth Bureau of Immigration Emigration Clearance Certificate (ECC) issuance.

Employer compliance obligations include:

- Monthly Withholding Remittances: Deduct graduated PIT (0-35%) from salary using BIR tables, file Form 1601-C electronically via EFPS, and remit penalties avoidable at 25% surcharge + 12% interest.

- Year-End BIR Form 2316: Issued by February 28, detailing total compensation, exemptions, withholdings; non-issuance incurs PHP 1,000-50,000 fines per BIR RMO 28-2004; employee retains 3 years for audits/refunds.

- Final Pay Processing: Upon resignation/termination, compute final tax on all unpaid compensation/deferred bonuses, issue adjusted 2316, and remit via amended 1601-C.

Exit tax clearance procedures for departing 9g holders:

- BIR Tax Clearance (CAR): Required only if BIR-registered assets (e.g., property, vehicles) or outstanding liabilities exist; apply at RDO with 2316, latest ITR, asset list—processing 5-10 days.

- Employer Final Clearance: Terminal pay report to BIR within 10 days post-departure; no CAR needed if purely salaried with clean employer withholdings.

- BI ECC Coordination: Immigration requires proof of settled taxes for long-term visa holders; employer 2316 + BIR certification suffices.

Common Mistakes and Pro Tips for Success

9g visa tax requirements oversights common; bullets + tips resolve.

Mistakes:

- TIN delay pre-payroll.

- Substituted filing ignored.

- Social reg lapses.

- Treaty unclaimed.

Tips:

- Employer TIN Day 1.

- 2316 audit annually.

- ITAD treaties early.

- Quarterly social checks.

Final Thoughts

9g visa tax requirements constitute a comprehensive compliance framework governing Taxpayer Identification Number (TIN) registration at the appropriate Revenue District Office, employer-managed monthly creditable withholding tax remittances through BIR Form 1601-C (graduated 0-35% rates or preferential 15% final tax for RHQ/ROHQ assignees), mandatory social security contributions encompassing SSS (14.2% total on PHP 20,000 cap), PhilHealth (5%), and Pag-IBIG (4% on PHP 5,000 cap), substituted income tax return filing via employer-issued BIR Form 2316 certificates eliminating personal ITR obligations for purely salaried expatriates, alongside potential double taxation treaty relief applications through BIR International Tax Affairs Division rulings for eligible nationalities.

These obligations persist irrespective of visa category but directly interface with AEP renewals and BI compliance verification, where lapses in TIN acquisition, withholding remittances, social registrations, or year-end certifications can precipitate fines ranging from PHP 1,000-50,000 per violation plus 25% surcharges and 12% interest, potentially jeopardizing immigration status through ECC blocks or deportation proceedings.

Expert Tax Navigation for 9g Visa Holders

For immediate implementation of 9g visa tax requirements compliance architecture tailored to your employment circumstances, professional stakeholders are cordially invited to contact Work Visa Philippines, where our multidisciplinary team comprising immigration counsel, BIR-registered accountants, and regulatory compliance specialists will conduct complimentary diagnostic assessments and delineate customized procedural roadmaps encompassing fiscal year 2026 deadlines:

- Contact Us Here

- Fill Out the Form Below

- Call us at +63 (02) 8540-9623