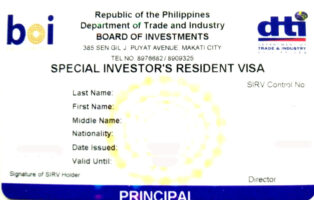

The SIRV Philippines program enables foreign nationals to obtain indefinite residency through a minimum investment of US$75,000 in approved economic sectors, administered jointly by the Board of Investments (BOI) and the Bureau of Immigration (BI). This Special Investor’s Resident Visa provides multiple-entry privileges, an Alien Certificate of Registration Identity Card (ACR I-Card), and inclusion for immediate family members without requiring active business management or employment. Unlike employment-based visas such as the 9(g) work visa, the SIRV focuses exclusively on capital contribution to priority industries, making it ideal for passive investors seeking long-term Philippine residency with minimal ongoing obligations.

Legal Framework and Program Objectives

The SIRV Philippines operates under Book V of the Omnibus Investments Code (Executive Order No. 226) and BOI implementing rules, designed to attract foreign capital into high-priority economic activities. Investments must support sectors identified in the annual Investment Priorities Plan (IPP), including manufacturing, exports, infrastructure, and services, while explicitly excluding real estate speculation, wholesale trading, and condominiums. The program’s dual-phase structure—probationary (6 months) followed by indefinite status—ensures actual fund deployment, with accredited depository banks (Land Bank of the Philippines and Development Bank of the Philippines) verifying compliance.

Eligibility emphasizes financial capacity and good character, requiring applicants to be at least 21 years old, possess no criminal convictions involving moral turpitude, and provide medical certification confirming the absence of contagious diseases or mental health institutionalization. Spouses and unmarried dependent children under 21 qualify as derivatives, receiving identical privileges upon principal approval.

Comprehensive Eligibility Requirements

Meeting SIRV Philippines’ eligibility demands requires thorough documentation of personal background, financial resources, and health status, verified through apostilled certificates and government clearances. Applicants must demonstrate immediate access to the required investment capital, typically proven through bank statements or liquid asset declarations from reputable financial institutions.

Detailed criteria include:

- Minimum age of 21 years at application.

- Clean criminal record, evidenced by police clearance from country of residence (fingerprint-based, apostilled).

- Medical certificate from an authorized physician confirming physical/mental fitness and absence of dangerous/contagious diseases, authenticated by the Philippine Quarantine Medical Service.

- Proof of US$75,000 (or peso equivalent) in freely convertible foreign currency, certified by an accredited depository bank.

- Commitment to invest exclusively in qualified activities: publicly-listed Philippine corporations, BOI-IPP priority projects, or approved manufacturing/service enterprises.

Dependents require marriage/birth certificates (apostilled/PSA-annotated) establishing relationships. No nationality exclusions apply, broadening accessibility compared to employment visas requiring reciprocal arrangements.

Qualified Investment Categories and Restrictions

SIRV investments channel capital into productive economic sectors, with BOI pre-approval required for non-listed options. Initial deposit occurs as a time deposit (30-180 days) at Land Bank or DBP, convertible upon probationary approval.

Permissible investments encompass:

- Equity in publicly-listed companies on the Philippine Stock Exchange.

- Ownership stakes in BOI-registered enterprises under the Investment Priorities Plan, covering manufacturing, export-oriented production, infrastructure, and technology.

- Direct participation in services sectors, including business/financial services, communications, construction/engineering, education, healthcare/social services, tourism/travel, and transportation.

- Minimum threshold of US$75,000 peso equivalent, maintained indefinitely (no top-up required for market fluctuations).

Prohibited categories protect local markets: real estate development, condominium ownership, wholesale trading, and retail operations. Private company investments necessitate audited financials and BOI certification of priority status. Annual holdings reports to BOI verify ongoing compliance.

Detailed Two-Phase Application Procedure

The SIRV Philippines application unfolds across probationary and conversion phases, processable at Philippine embassies/consulates abroad or the Manila One-Stop SIRV Center for in-country applicants. Total processing spans 1-3 months, accelerated by complete documentation.

Phase 1: Probationary SIRV (6 months validity)

- Submit the complete application package at the nearest Philippine diplomatic post or BOI Manila office.

- Remit US$75,000 to an accredited bank time deposit account (non-interest-bearing during probation).

- Pay US$300 processing fee plus PHP 10,110 BI visa fee.

- Receive a probationary visa stamp enabling entry and deposit conversion preparation.

Required documents:

| Category | Specific Items |

| Identity | Passport (6+ months valid), 2×2 photos, birth/marriage certificates (apostilled/PSA) |

| Clearances | Police clearance (apostilled), NICA/NBI clearances |

| Health | Medical certificate (no diseases), quarantine authentication |

| Financial | Bank certification of US$75,000 remittance, personal history statement |

| Forms | Completed SIRV application, affidavit of investment intent |

Phase 2: Indefinite SIRV Conversion

- Enter the Philippines physically within the probationary period.

- Convert time deposit to a qualified investment within 6 months (BOI verifies).

- Submit conversion documents 30 days before probationary expiry.

- Receive indefinite SIRV notation and ACR I-Card (initial 2-year validity).

Complete Fee Structure and Payment Process

SIRV Philippines’ costs center on administrative processing and initial deposit, totaling approximately US$75,300 upfront with minimal annual maintenance. Payments occur at accredited banks or BOI cashiers.

Comprehensive breakdown:

| Fee Component | Amount | Frequency |

| BOI/Embassy Processing Fee | US$300 | One-time |

| BI Visa Implementation Fee | PHP 10,110 | One-time |

| ACR I-Card (Initial 2 years) | USD 100 | Initial |

| ACR I-Card Renewal | USD 50 | Annual/Biennial |

| Investment Deposit (Minimum) | US$75,000 | Indefinite |

| Total Initial Commitment | US$75,410 + PHP 10,110 |

No investment income taxes apply during the holding period; deposit interest accrues pre-conversion. Annual BOI reporting incurs no fee but requires notarized holdings certification.

Key Benefits and Residency Privileges

SIRV holders enjoy permanent residency status with exceptional flexibility compared to tourist or employment visas. Indefinite validity persists as long as the investment threshold is maintained, eliminating renewal pressures associated with time-bound visas.

Principal advantages include:

- Indefinite Multiple-Entry Residency: No departure restrictions or re-entry permits required.

- ACR I-Card as Primary ID: Serves for banking, government transactions, and residency proof (2-3 year validity).

- Full Family Inclusion: Spouse and dependent children under 21 receive identical status.

- Investment Flexibility: Ownership rights in priority sectors; no active management mandate.

- Work Authorization: Implicit permission for investment-related activities (unlike strict 9(g) employer tying).

- Tax Treatment: Non-resident status on foreign income; local investment income is taxable normally.

SIRV holders access consular services abroad and qualify for certain social benefits, though citizenship pathways remain challenging (10+ years residency plus language/cultural tests).

Renewal Procedures and Compliance Obligations

SIRV maintenance focuses on ACR I-Card renewals and annual BOI reporting, far simpler than employment visa cadences. No investment re-verification occurs absent withdrawal notifications.

Annual obligations:

- BOI Holdings Report: Submit notarized certification of US$75,000+ investment status by January 31.

- ACR I-Card Renewal: Biennial/triennial at BI (USD 50 fee), requiring passport and prior card.

- Health/Criminal Compliance: Maintain clearances; report changes.

- Physical Presence: No minimum stay required for maintenance.

Investment liquidation triggers visa cancellation; market value fluctuations do not necessitate top-ups. Dependents renew concurrently with the principal.

SIRV vs. Alternative Residency Options

SIRV in the Philippines excels for investors but differs from other long-stay visas, serving distinct needs.

| Visa Type | Investment/Work | Validity | Family | Best For |

| SIRV | US$75k investment | Indefinite | Yes | Passive investors |

| 9(g) Work Visa | Job + AEP | 1-3 years, renewable | Yes | Employees |

| SRRV (Retiree) | US$10k-50k deposit | Indefinite | Yes | Retirees 35+ |

| Digital Nomad | Foreign income | 1-2 years | Limited | Remote workers |

SIRV uniquely balances low investment with permanent status absent employment ties.

Application Challenges and Mitigation Strategies

Common SIRV Philippines hurdles include incorrect investment categories, delayed conversions, and authentication gaps. Mitigation preserves timelines.

Pitfalls and solutions:

- Wrong Sectors: Verify IPP list pre-deposit; avoid real estate/wholesale.

- 6-Month Conversion: Enter the Philippines early; select investments promptly.

- Document Authentication: Apostille all certificates; use PSA for Philippine records.

- Bank Delays: Confirm LBP/DBP readiness; prepare multiple options.

Professional coordination prevents 95% of issues.

Key Takeaways

The SIRV in the Philippines delivers indefinite residency through a US$75,000 investment in BOI-approved sectors, featuring probationary-to-permanent progression, family inclusion, and minimal maintenance via annual reporting and ACR renewals. With US$300+ processing costs and 1-3 month timelines, it offers superior value versus employment visas requiring active labor participation. Work Visa Philippines ensures flawless execution for 2026 investor residency objectives.

Expert SIRV Processing Services

Work Visa Philippines provides end-to-end support for getting an SIRV in the Philippines, from eligibility assessment and document authentication through BOI filing, bank remittance, conversion, and annual compliance. Services integrate seamlessly with 9(g) or SRRV pathways for diverse client needs. Contact our team of experts to guide you:

- Contact Us Here

- Fill Out the Form Below

- Call us at +63 (02) 8540-9623