The Philippines stands out as one of Asia’s most attractive emerging markets for foreign investors. With a liberalizing economy, strategic geographic location, and robust investment incentives, the country offers significant opportunities across manufacturing, tech, infrastructure, services, and more. Yet, investing in the Philippines requires careful navigation of laws, ownership rules, and sector-specific restrictions.

Why Should You Invest in the Philippines?

The Philippine economy offers key advantages for foreign capital:

- A 100+ million mostly young, English-speaking population

- Sustained GDP growth and political stability

- Membership in ASEAN and access to important free trade networks

- Ongoing reforms for ease of doing business, digitalization, and infrastructur

Foreign Investments Act (FIA) and the Framework for Foreign Participation

The Foreign Investments Act (FIA) of 1991, updated by Republic Act No. 11647 in 2022 and further refined by ongoing adjustments in 2025, sets the foundation for foreign equity in Philippine business. The act welcomes foreign investment except in specific, reserved sectors and defines key processes, including:

- Minimum capitalization requirements (typically USD 200,000, but with incentives or waivers for export businesses and SMEs)

- Liberalization of formerly restricted sectors such as railways, airports, retail, and renewable energy

- Periodic review and publication of the Foreign Investment Negative List (FINL)

Understanding the Foreign Investment Negative List (FINL)

The FINL classifies industries as open, restricted, or closed to foreign equity:

- List A: Sectors limited or reserved for Filipinos by the Constitution or statute (examples: mass media, retail below PHP 25 million capital, small-scale mining, land ownership)

- List B: Sectors restricted based on defense, health, or security (examples: private security agencies, some defense-related construction)

Most export enterprises, BPOs, and manufacturing ventures are now open to up to 100% foreign ownership, including in specific greenfield sectors.

Sectors Open, Restricted, and Closed to Foreign Investment

Liberalized Sectors (Up to 100% Foreign Equity Allowed)

- Export-oriented manufacturing and IT/BPOs

- Wholesale trading meeting capital minimums (PHP 25 million)

- Tourism, hospitality, and logistics services

- Energy (renewables, transmission)

- Digital infrastructure and PPPs

- Contract growing in agriculture, railways, expressways, and some utilities

Restricted Sectors (Usually 40% Foreign Equity Cap)

- Land ownership (except through long-term lease)

- Public utilities (electricity distribution/transmission, water, telecoms, public transport)

- Media, small-scale retailing, cooperatives, and certain extractive industries

Closed Sectors (No Foreign Ownership)

- Mass media (except recording/music)

- Certain professional practices (unless via reciprocity)

- Certain security and defense operations

Recent Reforms: The CREATE MORE Act & Green Lanes

To boost competitiveness, the Philippines recently enacted major policies:

CREATE MORE Act (RA 12066, 2024)

- Expanded income tax holidays, flexible VAT incentives, and extended loss carry-over for high-value, innovative, or sustainable investments

- Broadened eligibility and length of incentives for PEZA and BOI-registered projects

Executive Order 18: Green Lanes for Investments (2023)

- Mandated one-stop shops and fast-track permitting for strategic and priority investments

- The BOI serves as the central agency guaranteeing expedited processing and coordination

How to Structure a Foreign Investment in the Philippines

If you’re starting a foreign investment in the Philippines, here are the things that you need to sort out:

- Select the Appropriate Vehicle

- Domestic corporation

- Branch or representative office

- Partnership (subject to restrictions)

- Capitalization and Registration

- Meet minimum capital and compliance (higher for retail, lower for export-oriented firms, higher for sectors in List A/B)

- Register with the Securities and Exchange Commission (SEC), the Bureau of Internal Revenue (BIR), and local agencies

- Incentives Registration

- Apply for BOI or PEZA registration for tax holidays, repatriation of profits, and favorable customs regimes

- Locate your business in an economic zone for maximum benefits

- Labor and Immigration Compliance

- Secure required work permits or visas for foreign staff; comply with DOLE and BI requirements

Visas Needed for Foreign Investors and Business Owners in the Philippines

Foreign investors and entrepreneurs planning to start or operate a business in the Philippines must secure the appropriate visas to legally stay and work in the country. The choice of visa depends on the nature of their involvement—whether as an active manager, passive investor, technical consultant, or business owner.

Common Visa Types for Foreign Investors and Business Owners

- 9(G) Pre-arranged Employment Visa: This is the most common visa for foreigners who will be actively employed in a Philippine corporation, including self-employed owners working as executives, managers, or technical staff. The visa requires a sponsoring company and an approved Alien Employment Permit (AEP) from DOLE.

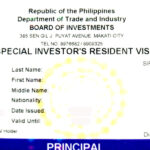

- Special Investors Resident Visa (SIRV): Designed for foreign nationals who intend to invest at least USD 75,000 in a Philippine enterprise, the SIRV grants indefinite residence so long as the investment is maintained. It allows investors and their dependents to live in the country without having to secure further work permits.

- 47(A)(2) Special Non-Immigrant Visa (PEZA/BOI Visa): For foreign employees or investors in companies registered with the Philippine Economic Zone Authority (PEZA) or Board of Investments (BOI). This visa is particularly relevant for workers and executives in export processing zones and special economic zones.

- 13A Non-Quota Immigrant Visa (Marriage Visa): Foreign spouses of Filipinos who become business owners or actively involved in enterprises may secure this visa for indefinite residence and work authorization (with a separate work permit).

- Special Work Permit (SWP): Temporary visa for foreigners working on short-term projects of six months or less without transitioning to full work visas.

Visa Application and Compliance Notes

- Foreign investors intending to manage or operate their businesses generally require a 9G visa, unless they are using the SIRV program.

- All employed foreigners must first secure an Alien Employment Permit (AEP) from DOLE to qualify for a work visa.

- Certain passive investors may enter the Philippines on tourist or investor visas, but cannot legally work without the proper visa and permits.

- Visa categories must be maintained and renewed in line with employment contracts, investment longevity, or residency status.

- Working with recognized immigration specialists can help navigate Philippine visa complexities successfully.

Incentives for Foreign Investors

The Philippines provides generous incentives, especially for registered businesses in priority sectors:

- Income Tax Holiday: Up to 6 years (renewable/extendable depending on activity and location)

- Special Corporate Income Tax (SCIT): 5% on gross income in economic zones after the ITH

- Tax and duty-free importation of capital equipment

- Simplified customs and trade processes

- Full profit repatriation and capital remittance

- Flexible labor and training provisions in economic zone

Land Ownership and Long-Term Leases

Foreign investors cannot directly own land, but can:

- Lease private land for up to 50 years (renewable for another 25 years)

- Own up to 40% equity in companies holding land

- Purchase condominium units (shareholding limits apply)

Practical Considerations and Common Pitfalls

- Long approval timelines if documents are incomplete or legal requirements are misunderstood

- Changes in FINL (published biannually) may affect sector eligibility—always verify the latest version

- Securing all necessary local permits (environmental, sanitary, municipal) is critical for compliance

- Local partner selection is essential for sectors with mandatory Filipino participation

- Professional legal and business consultation reduces costly errors and accelerates market entry

Key Takeaways

Foreign investment in the Philippines holds enormous potential for those who understand the legal landscape, evolving incentives, and sectoral opportunities. With new liberalized sectors, streamlined application processes, and a strongly pro-investor regulatory policy, 2025 is one of the most promising times to invest in the country.

Need Help Navigating Foreign Investment in the Philippines?

Work Visa Philippines specializes in helping foreign investors with market entry, corporate formation, incentives registration, and immigration compliance. Our expert team guides you from planning to approvals for a smooth and successful investment journey:

- Contact Us Here

- Fill Out the Form Below

- Call us at +63 (02) 8540-9623